Foreign Portfolio Investors (FPI DESK)

Foreign Portfolio investor refers to Foreign Institutional investors (FIIs) or their sub-accounts or qualified foreign investors (QFIs) who are permitted to hold upto 10% stake in a company. FPI align to nomenclature of categorizing investments of foreign investors in line with international practice. FPI's generally participated through the stock markets and gets in and out of a particular stock at much faster frequencies.

We regularly hold conferences, plant visits, road shows and schedule corporate meeting for the benefit of our clients. Timely interpretation & impact of economic data is used beneficially by our clients. In the derivatives segment we were amongst the first to trade derivatives contracts in India on launch and are rated amongst the top by our clients. Establishing our leadership in the institutional space, we provide our clients access to advanced & efficient technology for trade execution - DMA, FIX, Co-Location facility, & customised Algos etc.

Our clients benefit from our local expertise, international perspective, and scale, while institutional investors can access our team of highly regarded equity & derivatives research analysts and top class execution capabilities. Our research team provides in-depth analysis and ongoing research coverage of over 160 companies in 14 sectors.

Instruments available for Investment

| Asset Class | Description |

|---|---|

| Equity |

|

| Derivatives |

|

| Debt |

|

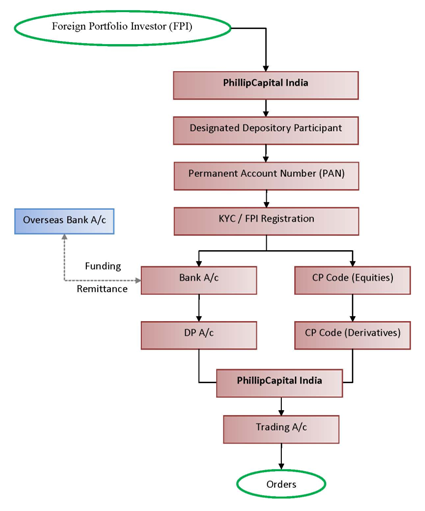

Operational Flow Chart